What strategies should they be considering right now?

Our super, soaraway much-loved media might be clambering over each other to paint a thoroughly dystopian picture of the shattered commercial wastelands of life after March 30, 2019. B-Day. Brexit Day. Cue clap of thunder and flash of fork lightning. The day the United Kingdom is actually, properly, finally scheduled to leave the European Union.

In the other corner – we know the narrative all too well by now – UK politicians are grappling, supposedly on our behalf, with regular prompts, corrections and knowing nods from civil servants on mildly-esoteric topics such as tariffs, the customs union and the will-they-won’t-they question of frictionless, borderless freedom of movement on the island of Ireland, and to and from the Emerald Isle to the UK.

And here’s a thing: each little pearl of received and regurgitated Westminster-led wisdom is guaranteed to bamboozle and turn off both retailer and consumer in equal measure.

Make no mistake: there will be rumbles and aftershocks underfoot on March 30, 2019 and beyond. Markets hate uncertainty – or so they always claim – while uncertainty and a vacuum get on like a house on fire.

Distance-selling regulations could yet become a minefield for e-retailers accustomed to seamless fulfilment processes. Those dread words – extra taxes and duties – could likewise produce a downward drag on ecommerce operations’ inbuilt necessity for friction-free, start-to-finish transaction and delivery.

A government using its smarts here, should be on the money with an urgent brief to tweak UK competition law as soon they can post-Brexit, to give a shot in the arm to both brand and consumer.

However, the nimblest and sharpest of e-retailers have thus far already benefited at their bottom line with a rise in ecommerce exports, thanks to the relative weakness of the pound.

This is borne out in positive figures signalling a cross-border retail boost by the British Chamber of Commerce. The BCC cites in a report a 16 per cent upswing in manufacturers’ exports since the UK’s referendum on EU membership on June 23, 2016.

But that on its own is no reason to put your feet up and light a fat one. Go-ahead UK e-retailers will need to stay single-mindedly – if not necessarily single-market-ly – ahead of the new realities. And while doing so, they should expect the pound to bob up and down like a coracle in a force ten, quite possibly somewhere off the coast of Ireland.

Sterling is a resilient beast, but prone to the odd bout of hypochondria. So it’s crucial that e-retailers don’t solely obsess about Brexit’s impact on European markets, and instead skew their business models towards adopting a more global mindset.

Indeed, notions of Europe as a one-size-fits-all electronic marketplace also need to be dispelled.

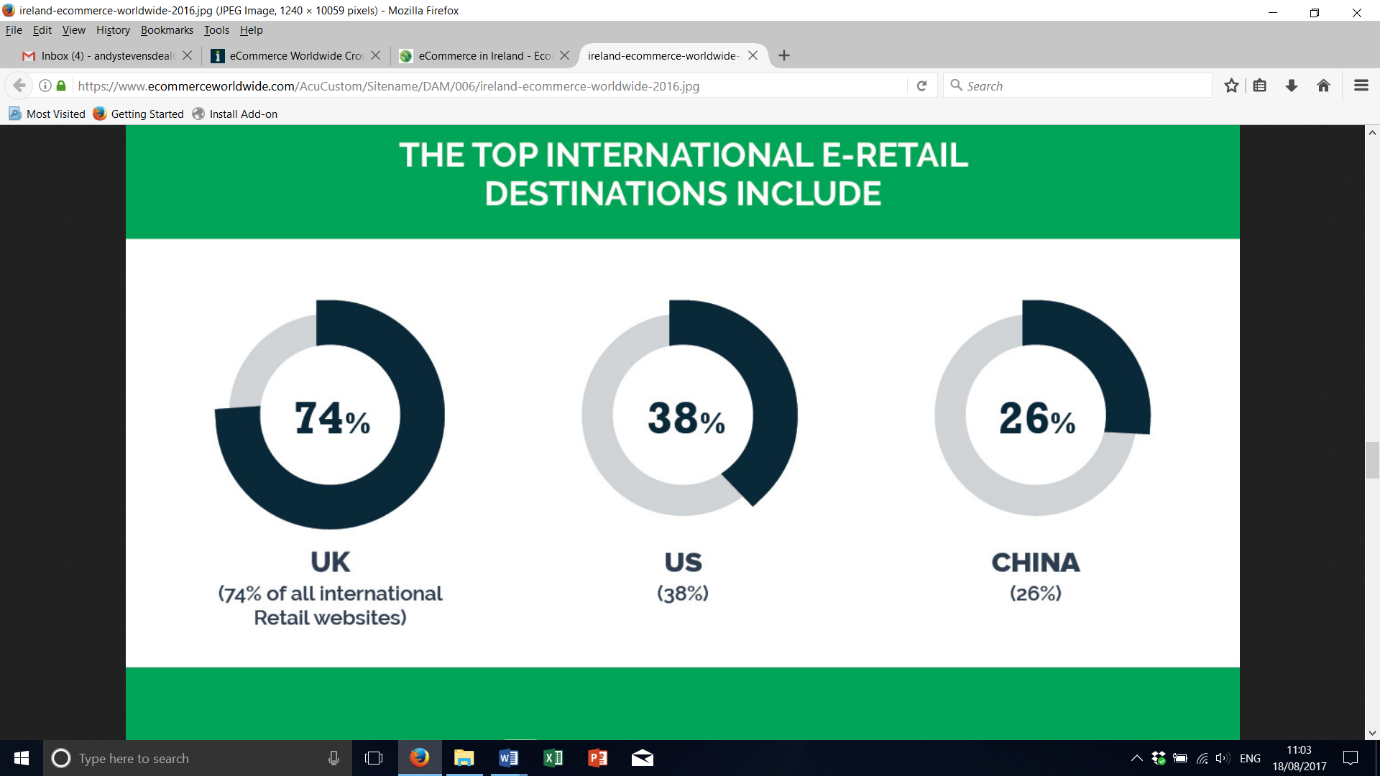

For example, in its bellwether guides to ecommerce trading health, IMRG speaks glowingly of Ireland’s e-retail dynamism and the strength of its cross-border trade (see graphic below), while Belgium, somewhat surprisingly, isn’t quite fulfilling its obvious logistical potential, even though the signs for the future are good.

Then take France and Germany. The neighbouring nations might be lauded or derided in equal measure as political besties, but ecommerce’s tentacles have an unshakeable and ever-growing grip in Germany. Surprisingly less so in France, where quaint concepts such as the department store still, incredibly, hold some sway.

Who better – and certainly bigger – than Amazon to back this up with empirical fact, courtesy of their unchallengeable e-retail muscle, using powerhouse Germany as a model.

And in so doing, the online giant offers a none-too-subtle hint about the existential need for ambitious, sharp-eyed UK e-retailers to look east, and reach out now to connect with the vast bounties of the Asian ecommerce marketplace.

A report by Freight Hub points out that amazon.de has extended its free delivery service to Scandinavia and other territories, including the Czech Republic and Hungary.

At the same time, Amazon’s own delivery service has started biting chunks out of DHL’s delivery share in some German cities; a rather schizophrenic arrangement, given that Amazon is believed to be responsible for around 30 per cent of DHL parcel volumes and a quarter of its revenue (source: Credit Suisse). We trust they’ll still get along fine.

So what does Amazon’s unstoppable reach have to do with humbler, leaner UK e-retailers’ strategy for life after Brexit? Well, it speaks volumes – if you’ll excuse the pun – about the big guy’s endless thirst for world-class innovation across the whole spectrum of delivery and fulfillment.

Innovation is without doubt the key for e-retailers aiming to thrive after Brexit, spearheaded by embracing ever-changing technology trends and keeping a gimlet eye on the competition’s next moves at all times.

Confidence remains an issue in the run up to B-Day, however. But as the furious activity among Whitehall mandarins reaches fever pitch – and we ain’t seen nothing yet – there are the odd mollifying words coming out in small rations from those who claim to be in the know.

Take the customs union. No, honestly, after you…you take it. In an Air Cargo Week report, the Freight Transport Association has tentatively welcomed a government paper suggesting temporary customs union arrangements. This would act as a transitional scenario to keep cross-border trade with Europe flowing freely during the post-Brexit birth pangs.

Were this the case, the FTA goes on to urge the decision makers to tap into the well of knowledge of logistics professionals – and invite them to the negotiating table. Another case of wait and see, perhaps.

What strategies should UK-based e-retailers be considering right now?

While the UK government frets, fiddles, obsessively watches the news-ticker of public opinion and moves more goalposts than Hackney Marshes in its heyday, agile and forward-thinking ecommerce operations have gilt-edged opportunities to carry on being, well, what they always have been: entrepreneurial.

After all, it’s that very can-do zeal which catapulted many of the UK’s (and UK-based) most successful ecommerce players, be they big or small, into the profitable embrace of the stratospheric opportunities in a truly-global market in the first place.

And to think big. Big – and strategically, too. Bigger than ever before, and not get bogged down in Brexit’s often-alarmist white noise, nor the government’s near-pathological desire not to overly scare the Brussels horses.

If confused politicos leading the post-Brexit charge lack the wit or wisdom to do that, then forward-thinking ecommerce entrepreneurs, and established e-retailers of all shapes and sizes, should take that lead organically themselves. And in so doing, make sure the UK’s robust, mature and long-established position as a top destination for electronic buying and selling is redoubled and then some.

Looking at things in reverse, the UK in this pre/post-Brexit everyman’s land has a real chance to court yet more big tech firms to its shores. Ireland has long since romped past this winning post, of course, by giving home to a world-beating stable of technology thoroughbreds. But if you can’t beat ’em, copy ’em.

There is infinite capacity, too, in post-Brexit Blighty for umpteen lean and mean start-ups to steal a disruptive march on lumbering competitors slow to get out of the ecommerce blocks.

It’s also time to take the blinkers off and your headset on: emerging technologies must be embraced fully in the round, if you are to leverage greater e-retail success, especially in the sunny ecommerce uplands of the Far East, where the yuan and yen reign supreme.

A report by Internet Retailing pinpoints the sales-growth benefits and potential market-leading edge to be had with ‘next generation tech’ such as AI, VR and AR, which will inexorably change the way we shop – even in the dear old high street.

Any ecommerce outfits still wondering which road to take next should be heartened by Internet Retailing’s uplifting observation this month that the “UK leads the way in social media driving traffic to retailer websites” (source: Q2 17 Shopping Index, which canvassed no fewer than 500m+ shoppers worldwide).

And sorry to say this, but if your post-Brexit e-retail strategy isn’t geared towards mobile-first, well, we’ll get your coat for you.

Savvy e-retailers limbering up for Brexit should also be mindful of costs – hidden or upfront – within the electronic payment platforms you currently use, or might be thinking about taking on board. Or, rather, how to reduce those costs and keep your ecommerce outgoings low.

And with currencies potentially set to do a full-scale dervish routine come B-Day and beyond, this could have a dramatic and deleterious impact on your P&L.

But don’t just focus on what Paris and Frankfurt may or may not be playing at; make sure you e-business strategy also factors in any unseemly sparring between the pound and dollar, and any other global currencies on which your company’s bottom line relies.