What characteristics do they have, where and what do they buy, and how?

How to unlock the untapped future smartphone spending power of the millennial generation is one of the biggest challenges in the inexorable rise of mobile commerce.

Today’s millennial consumers – that much-discussed, digital-first demographic and regular media fixation born anywhere between 1980 and 2000 – will be tomorrow’s fortysomething trillion-dollar, m-commerce spenders, as their disposable incomes climb exponentially in the 2020s and beyond.

So how do savvy m-commerce operators, and switched-on digital retailers in general, grab this goose that’s already starting to settle down and lay its golden egg?

Well, they’re going to have to take some time to correctly identify this lucrative – at times elusive, fast-shifting and always surprising – target market first.

And as is the case with not just millennials, but younger generations who preceded them, youthful consumers aren’t always easy to pigeonhole.

Here’s a simple fact, often overlooked in the latest digital gold rush: millennial consumers are individuals like anyone else and, as such, prefer to do things their own way.

It’s a naive m-commerce retailer indeed who assumes there’s some easily-categorised groupthink at work among these digital natives, which can be monetised with little effort, let alone a clear strategy.

The reality is more complicated, although there are common threads and best practices which do dovetail in the quest for millennials’ coveted transactional point-and-click conversions.

And the prize is huge. Take Europe, for example. Findings by Forrester Research reveal that the value of mobile transactions in France, Germany, Italy, the Netherlands, Spain, Sweden and the UK will grow nearly threefold, from $52bn two years ago to $148bn by 2021.

Much of this growth, according to Forrester, will be spurred by now-standard contactless payments, in-app and mobile purchases, plus desktop and peer-to-peer transactions.

This graph from Forrester also shows the expected increase of purely in-person mobile transactions across the seven biggest European economies by 2021:

What characterises a millennial consumer?

Millennials’ spending methods and habits already offer a glimpse of the sunny uplands of that trillion-dollar m-commerce future. The dominance of purchasing technology on smartphones will grow at lightning pace as the 2020s find their feet.

But a word of warning. Not any old retailers simply trying to sell goods and services on smartphones to the 2020s’ moneyed, fortysomething tap-and-scan consumers will survive this next digital riptide.

Millennial consumers expect a streamlined m-commerce experience. Every time. From the eureka moment of finding that must-have on their smartphone to completing the transaction, the whole thing must be painless – and preferably all over in the fewest possible keystrokes.

Likewise, brands which deliver cross-platform consistency in their selling processes will discover how crucial this is for repeat business among millennial consumers. They’re all about hassle-free transactions. It’s the only game in town.

Consistent experiences for users across all aspects of the brand are a millennial must. Faster, simpler, better, reliable and robust transactions are the key. Pivotal to this, according to research by Accenture, should be “a single ‘conversation’ with customers” which doesn’t change “from smartphone to PC to physical store”.

This drive for commercial consistency can’t be emphasised enough. Unless m-commerce retailers can provide millennial consumers with seamless, streamlined systems for purchase and payment, they will in the blink of an eye disengage and buy elsewhere – or not buy at all.

Loyalty is another underestimated commodity among millennial consumers. And an often-misrepresented commodity at that, commonly preceded by the words “lack of”.

Not so. Millennial consumers have plenty of loyalty: but not as you know it.

That loyalty should be viewed by m-commerce operators in – figuratively-speaking – widescreen, rather than simply assuming these consumers stick to their favourite brands. They don’t: certainly not forever – or sometimes at all. But millennial consumers’ own take on loyalty, moreover, is to the whole end-to-end m-commerce experience.

If it works well, it’s simple and, again – that word – painless, then mobile retailers will have won phase one of the battle to engender loyalty and retain custom.

Crucially, this loyalty among millennial consumers also hinges on that old-fashioned but enduring commodity of a competitive price, plus tasty discounts and any promotions that are going. There’s nothing fancy about it: price and excellent value remain time-honoured premiums for consumers, whichever demographic slot they find themselves in.

Furthermore, millennials expect consistency of price between online, mobile and store. Stores: yes you…look and learn.

Don’t forget, either, that seeing is spending. The emotional chain triggered by strong, high quality visuals play a huge role in millennial consumer patterns. Here, screen size does matter.

Sharing photos and videos on image-led social networks such as Pinterest and Instagram, and on messaging platforms favoured by younger users such as Snapchat and China’s dominant WeChat, cement future consumer behaviour. They are powerful ways in which millennials choose to disseminate a feelgood buzz between friends around products and services.

Research by Channel Advisor pinpoints millennial consumers’ quest for “self expression”. Two out of three millennials surveyed believe the brands they choose “reflect their style and personality”. The remaining respondents weren’t far off, either: they simply aspired to that same feeling.

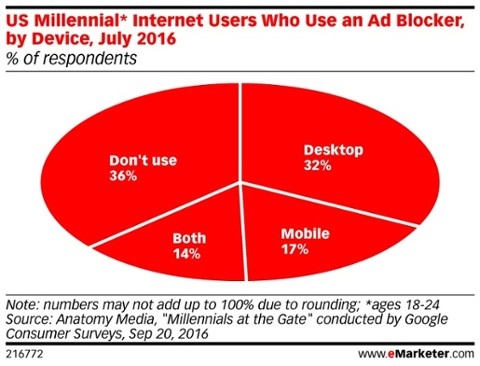

There’s more unwelcome news for battle-hardened advertising teams, who mistakenly think that foisting shiny trinkets on millennials’ smartphone screens is the key to commercial conversion. As the eMarketer.com graph below grimly reveals, 63 per cent of US millennials simply don’t want to know, and use an ad blocker to zap such intrusions:

Where and what do millennial consumers buy, and how?

Whatever millennial consumers are buying, they’re certainly buying more of it.

Electronics, gadgets, accessories, gifts, internet-only one-off novelties, clothing, footwear, lingerie and flowers all figure strongly and consistently through the retail year. Tellingly, however, IMRG/Capgemini research in early 2017 saw the predicted seasonal Christmas 2016 spike exceed expectations for purchases on smartphones, climbing by an eyebrow-raising 47 per cent year on year.

Furthermore, the ripple effect of Black Friday and Cyber Monday beyond the USA into established seasonal spending patterns will continue to drive strong m-commerce growth every year.

But unlike some knee-jerk wisdom might suggest, certain millennial buying habits aren’t that different from previous generations.

You’ll still find millennials in the mall, trawling the shops. But you’re less likely to see them leaving the store juggling bags groaning with goods before hailing a cab.

Some patterns of purchasing are, though, markedly different for the millennial generation. This is a generation, it barely needs repeating, for whom notions of a non-wired world are mere folk chatter from a flickery, unremembered past: like mobile phones without internet access, or those televisions where you had to get up to change channels that older people sometimes mention.

Take millennials’ love of showrooming, for example; no longer, it must be said, the sole preserve of that generation when it comes to savvy buying.

The ever-present smartphone in hand is more than likely being used as an in-store, price-comparison device, browsing for the best deals online before taking the plunge (or not) with a conventional over-the-counter transaction.

If anyone from Amazon to Alibaba, Asos or beyond is selling the same item at a lower price, or even equivalent goods with that compelling mix of not just cheaper but better, then those retailers with more effective m-commerce smarts will grab that sale.

Likewise, trawling of reviews and product ratings, friends’ tip-offs about bargains, plus direct engagement with online sellers, all combine in the informed armoury of the millennial consumer.

And these aren’t the only tricks up millennial consumers’ sleeves destined to keep m-commerce outfits super-agile in the coming years.

Mobile scanning options in-store, discount coupons with mobile codes, straight-to-smartphone quick-win text and email offers, plus in-app payment buttons are essentials on the business to-do lists of effective mobile retailers.

From the m-commerce operators’ viewpoint, backend technology such as quality analytics, data capture, plus ever-smarter ways of fostering consumer loyalty and repeat custom through behavioural targeting are vital business tools for any mobile retailer or e-commerce outfit looking to grow, and take their millennial consumers along for the ride.

Mobile-first retail brands who can manage that process seamlessly, time and again, will go a long way towards harnessing what is still regarded as something of a magic formula; that is to demystify – and unlock – the elusive but ever-rising spending power of the oft-mythologised millennial.

But are millennial consumers’ purchasing patterns really such a mystery, as eyes-on-the-prize mobile marketers and brand gurus would have you believe? As you can see above, there are plenty of myths worth laying to rest, while some enduring assumptions about millennials’ retail behaviour do endure.

But even with the latest, hottest smartphone in hand, and a finger poised over the ‘Buy Now’ button after an untroubling, fully-responsive pre-purchase experience, people are people and, as is the nature of the beast, habits can be fickle.

As any company trying to build their sales profile and bottom line through smartphone technology knows, every m-commerce platform is just one slow-loading end transaction or error message away from never seeing that buyer again for dust. Nor any of their friends

You must be logged in to post a comment.