This first article on the Certis24 website ‘Industry News’ section focuses on the retail and eCommerce boom in China and how that is shaping the online world, as Chinese shoppers become more discerning and more global in their outlook and spending

Insights on China’s retail and eCommerce boom

China is now the world’s largest eCommerce market. Global consulting and research group KPMG, in its 2015 study ‘China’s Connected Consumers China’s, puts a value of China’s eCommerce market at around US$426 million in 2014 and is projected to grow to US$1 trillion by 2018-19.

The Chinese shopper is seen as a driving force in a multi-channel retail environment, where shopping takes place both in stores and online. China is projected to become the powerhouse of middle-class consumerism over the next two decades. www.kpmg.com/cn

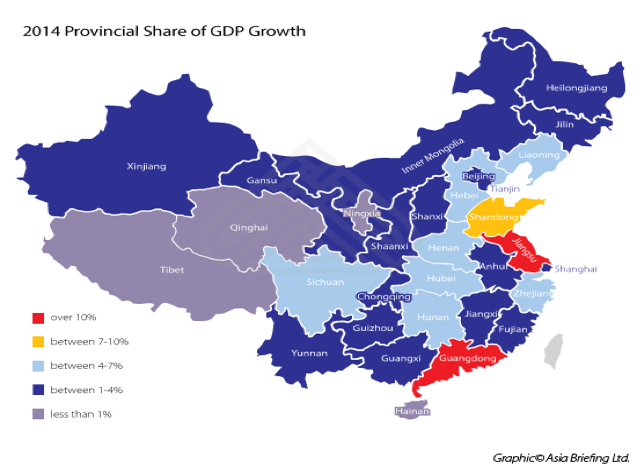

GDP Growth

China’s GDP (Gross Domestic Product) ‘shrunk’ from the 8% level in 2014 to 7% in the first two quarters of 2015. Slower GDP growth has a braking effect on higher and luxury spending, but also means that many Chinese luxury consumers seek better value for money. They now purchase goods overseas either online through websites, personal shopping trips, or by making use of ‘daigou’ – where overseas-based Chinese middlemen purchase goods on behalf of shoppers in China.

In 2012, China set a goal to double its 2010 real GDP and per capita income by 2020. Between 2011-2015, GDP grew by an aggregate 46 percent. To reach the goal of double GDP, an average annual growth rate of 6.5 percent is necessary in each of the next five years. At that rate, China’s total GDP of RMB 67.7 trillion would reach RMB 92.7 trillion by 2020, or US$14.15 trillion at current exchange rates. That is approximately two thirds of the United States’ GDP.

Provincial GDP in China helps to understand the purchasing power of consumers spread throughout the country. There are disparities inevitably, between the actual share of GDP and the growth trends being experienced in the provinces outside the main centres of the eastern coast. Growth hotspots comprise Guangdong, Shanghai region, the Yangtze River delta and Shandong provinces.

Source: http://www.china-briefing.com/news/2015/10/26/chinas-gdp-growth-more-shocks-ahead.html

Online Retail Data

The Internet and mobile technology is quickly changing China’s economy. Online retail spending is estimated to reach US$1,132.8 billion in 2020, almost tripling the 2014 figure of US$ 442.2 billion. The Internet penetration rate is estimated to reach 70% percent by 2020, from 50.3 percent in 2015. (China Business Review 2015).

Luxury online shopping

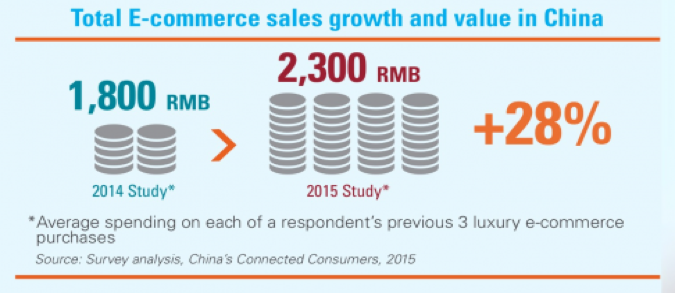

Increasing demand for online luxury shopping reveals that spending increased by 28% in 2014 compared to 2013, with online shoppers spending an average of RMB 2,300 (US $362) per transaction. Consumers are willing to shop online for most categories – not just computer games and gadgets – but classic luxury sectors such as branded belts and handbags. This represents a massive increase in consumer confidence when it comes to luxury eCommerce.

Looking at the world’s fastest growing fashion cities by category, we see numerous Chinese cities are categorized as emerging ‘mid-market’ cities for omni-channel fashion sales. The trend of ‘O2O’ (offline to online) is taking hold where consumers freely move between the online world of shopping platforms, social media, websites and blogs, to the real world where they visit shops, chat with friends and browse magazines.

Source: https://shenglufashion.wordpress.com/2014/10/17/unleashing-fashion-growth-city-by-city/

KPMG analyzed Chinese shoppers’ previous three luxury eCommerce purchases and found that this recorded a 28% increase between 2014 and 2015 where the average spend rose from RMB 1,800 (US$277) to RMB 2,300 (US$354).

Source: www.kpmg.com/cn – China’s Connected Consumers 2015

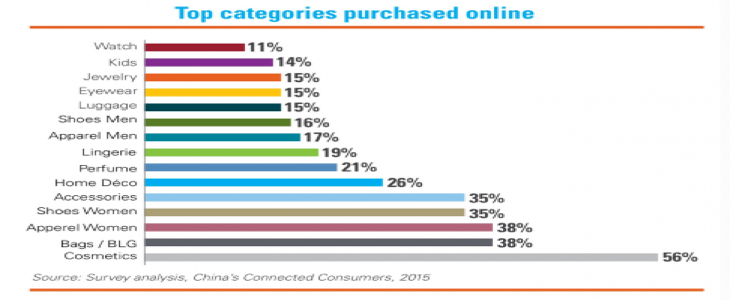

There is a clear desire for the Chinese to buy cosmetics, accessories and fashion/apparel online and increasingly so, from overseas, international brands, as can be seen in the chart below, from KPMG’s ‘China’s Connected Consumers’ Study.

The principal reasons that prompt the Chinese to shop on international platforms (for example on Alibaba’s TMall and TMall Global portals), and to a lesser extent on direct websites, include:

- Price discrepancy between luxury products sold in China and the ones sold overseas

- Increase of personal wealth

- Limited product selection in China

- Importance of the country of origin

- Gift tradition

- Authenticity of the products

- Relaxation on international visa rules permitting easier international travel

Source: http://www.albatrossasia.com/7-reasons-why-chinese-luxury-consumers-prefer-to-buy-abroad/

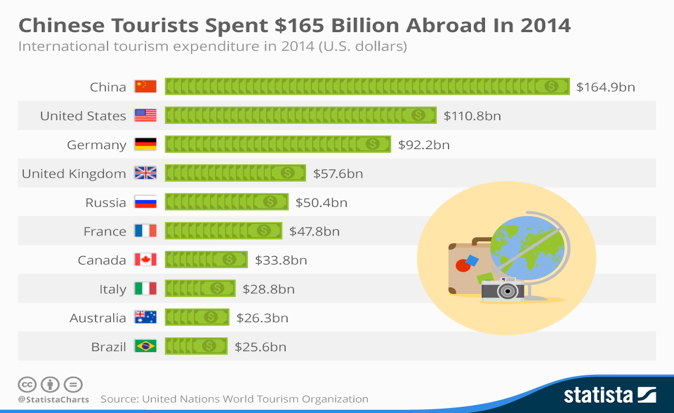

Chinese travellers on the move

Any brief overview of China’s retail and eCommerce tends would be incomplete without reference to the phenomenon of Chinese travelling overseas to shop. The Chinese are becoming avid travellers and are prepared to spend significantly when so doing; research from ‘Statista’ shows that the Chinese are the world’s top spenders when compared with other nationalities.

Source: https://www.statista.com/chart/4125/chinese-tourists-are-the-worlds-top-spenders/

It is estimated that over 100 million Chinese travelled overseas to global cities in 2014; that number will be close to double that (c. 200 million) by 2020.

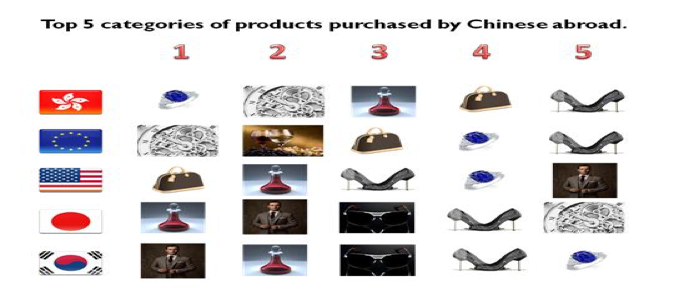

When travelling abroad, the main product categories purchased by country show clearly the focus on luxury items, including jewellery, watches, fashion and apparel, footwear and accessories.

Source: http://www.albatrossasia.com/7-reasons-why-chinese-luxury-consumers-prefer-to-buy-abroad/

An example from the U.K. – Bicester Village

Here in the UK, we can see that international Chinese luxury traveller effect in ‘real time’ through what I call ‘The Bicester Village (Chic Shopping) experience’.

Bicester – a relatively small market town in the Oxfordshire (U.K.) countryside has been transformed by the arrival of ‘Bicester Village’, which is home to over 130 ‘luxury and designer’ stores and has become a magnet for the shopper seeking luxury and value for money.

Bicester – a relatively small market town in the Oxfordshire (U.K.) countryside has been transformed by the arrival of ‘Bicester Village’, which is home to over 130 ‘luxury and designer’ stores and has become a magnet for the shopper seeking luxury and value for money.

Overall, the outlet mall now attracts 6.3 million shoppers a year, making it second only to Buckingham Palace on the ‘must visit’ locations for tourists from China. In fact, 8 in 10 Chinese visitors to London make this pilgrimage during their visit to the U.K. To welcome them, London’s Marylebone railway station has installed signs in Mandarin and announcements on trains are also in Mandarin.

This proves how global shopping has become and how the Chinese are leading the world in seeking new and varied ways of getting the bargains they seek!

Chris Stevens

© Certis24 Limited, April 2016

You must be logged in to post a comment.